The modern shopper has transformed, and with it, the world of commerce. Today, the line between online and offline shopping is not just blurring, it's practically disappearing. The recent 2023 Carat Insights report from Fiserv offers a comprehensive glimpse into this transition, revealing a future where experiences straddle both the digital and physical realms.

One of the standout trends is the Buy Online, Pick-Up In-Store (BOPIS) model. With 59% of consumers favoring online purchases and brick-and-mortar pick-ups, it's evident that the convenience of e-commerce combined with the tangibility of offline shopping is irresistible to many. BOPIS, which found its wings during the early COVID-19 days, shows no signs of plateauing. The method which attracted 47% of consumers in 2022 has grown to 50% this year. A closer look reveals it's the younger crowd leading the charge - 85% of both Millennials and Gen Z are avid BOPIS users.

Financial forecasts further highlight this shift. eMarketer's data suggests Americans spent nearly $96 billion using the BOPIS method in 2022. Astonishingly, this number is projected to catapult to over $154 billion by 2025. Where is this trend most prevalent? Restaurants top the list, followed closely by other retailers and grocery stores.

Despite the evolving shopping methods, one thing remains constant: the discerning nature of consumers. In an age of inflation and economic uncertainty, 59% of those surveyed shared that pricing remains their paramount concern when choosing a shopping channel.

The digital frontier is expanding with the proliferation of retailer apps and digital wallets. A notable 64% of consumers have used digital wallets for online shopping in the past year, marking a 4% increase from 2022. Their motivations are clear: ease of use, in-app payment capabilities, loyalty programs, and options for in-store pick-up or delivery. Moreover, a significant chunk of shoppers lean towards retailer apps over third-party counterparts, mainly driven by cost concerns.

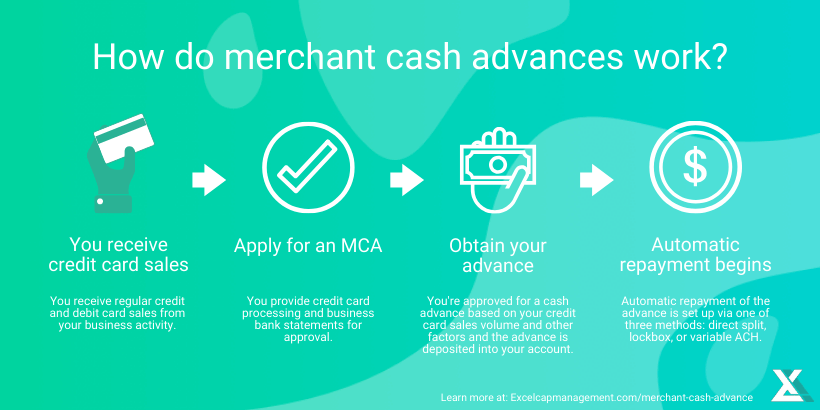

Businesses are not just standing by; they are proactively seeking ways to redefine the financial aspects of the customer journey. Two innovations stand out - the instant issuance of cards during checkout and the 'pay-by-bank' feature. The former has captured the interest of 61% of consumers, while the latter appeals to 34%.

An interesting side note from the report is the continued preference for debit cards over credit cards, both in online and in-store shopping scenarios.

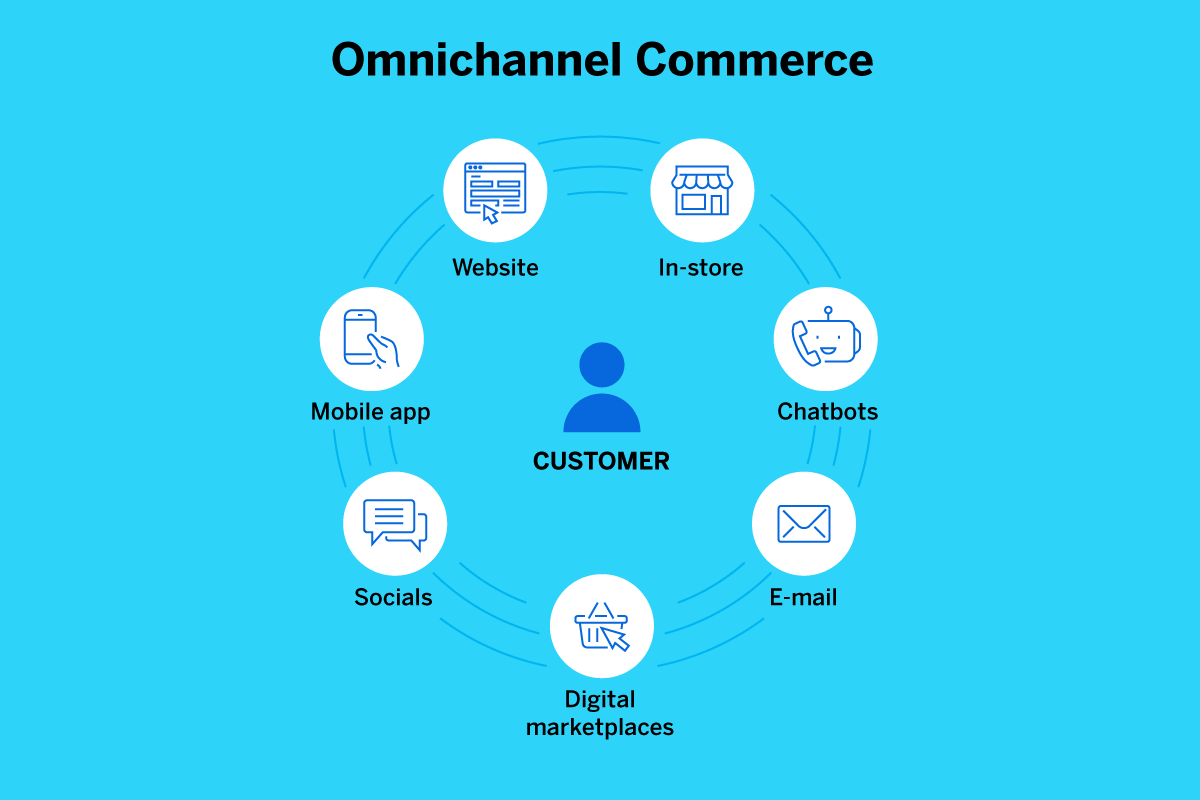

Casey Klyszeiko, the visionary behind Carat and Global eCommerce at Fiserv, summarized the landscape perfectly: "Businesses have tremendous opportunity to deepen relationships with customers by enabling omnichannel experiences that streamline the purchasing process."

In essence, the future of commerce is a seamless integration of online and offline experiences, facilitated by innovative financial solutions. It's an exciting era for retailers and consumers alike.

Be careful out there and get with the right partner with the experience to know what small businesses need. Reach out to me directly at the number below or schedule a zoom if you need help or just need a free consultation.

Proudly created with SemanticsMarketing.com