In the complex landscape of business financing, merchant cash advances (MCAs) stand out as a unique and often controversial option. Primarily aimed at businesses in need of quick funding, MCAs offer a lump sum of money in exchange for a portion of future credit card sales. Understanding the nuances of this financial product is crucial for any business considering it as a funding option.

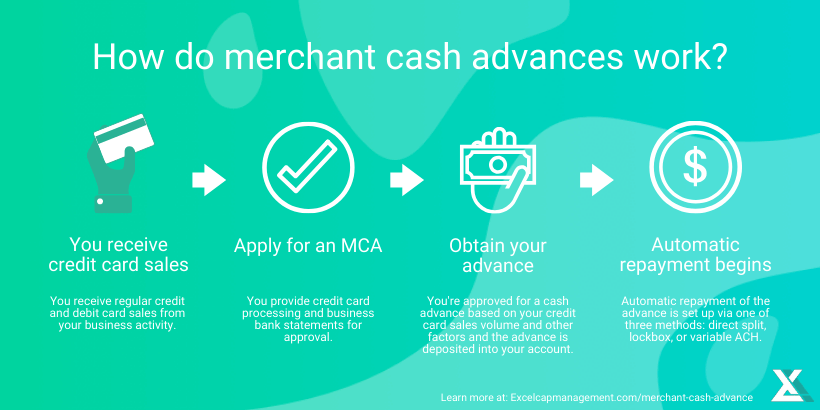

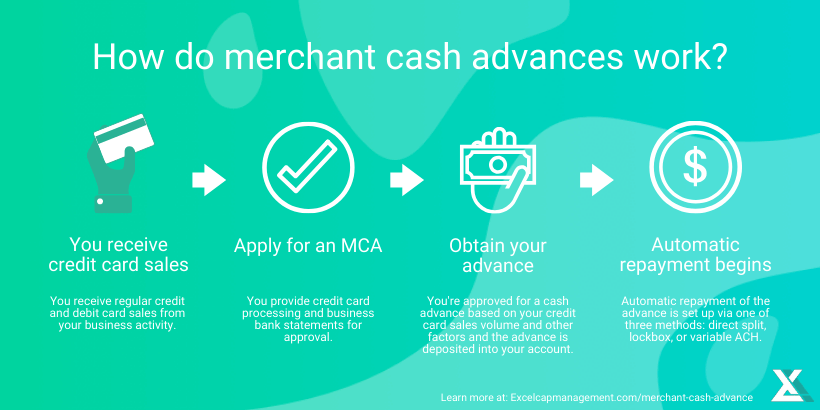

A merchant cash advance is not a loan but a financial agreement where a business receives a lump sum upfront. This amount is then repaid through a percentage of the business’s daily credit card sales. It's essentially a sale of a portion of future sales revenue to the cash advance provider.

Much like traditional business loans, MCAs can be used for a variety of purposes. Businesses often use them for advertising, inventory purchases, expansion, renovations, or acquiring new equipment. Providers like Square Capital and others offer MCAs as a form of working capital for businesses that might be short on cash.

Merchant cash advances do have certain advantages:

However, the cons of MCAs often outweigh the pros:

Businesses should weigh their options carefully before opting for an MCA. While they can provide quick access to funds, the high costs and potentially unclear repayment terms pose significant risks. It's essential to read and understand all contract details and possibly consult an attorney for clarity.

Merchant cash advances offer quick access to capital but at a high cost. They should be considered only after exploring other financing options. Businesses must approach MCAs with a full understanding of their terms and implications, ensuring they make an informed decision aligned with their financial health and long-term objectives.

With SPS and our partners, if the business closes, the owner is not responsible for the balance. Find the right relationship.

Be careful out there and get with the right partner with the experience to know what small businesses need. Reach out to me directly at the number below or schedule a zoom if you need help or just need a free consultation.

Proudly created with SemanticsMarketing.com